You could take your dividend money in cash and spend it. And, one day you will want to do just that. I plan to use future dividends as a major source of retirement income.

But until then, my dividends are reinvested.

Dividend Growth Stock

A well chosen dividend growth stock has demonstrated its ability to grow earnings per share and therefore - over time – its share value. It’s also increased its annual dividend in proportion to earnings growth.

A company may not do in the future what it did in the past; it’s nevertheless more likely to continue such policies than is a company that’s never consistently grown its earnings and dividends.

Compounding Earnings per Share (EPS)

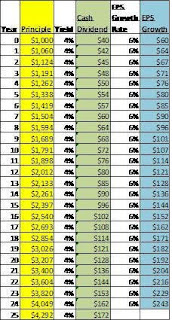

A conservative example of a typical dividend growth stock – perhaps an electric utility – is shown in the chart below.

An original investment valued at $1,000 is assumed; with no additional future purchases. All dividends are assumed paid in cash and used as disposable income.

For simplicity, the normal fluctuations of business are assumed away - at conservative averages. A constant 4% dividend yield is assumed; as is constant annual earnings per share (EPS) growth of 6%. Constant market valuation based on the Price/Earnings Ratio (P/E) would make the value of the investment increase at the same 6% rate of EPS growth. Also, all compounding is shown as annual. Quarterly compounding (the reality) would increase the resulting values in all cases.

After 25 years of 6% annual growth your original $1,000 investment is worth $4,292 and the you received $2,366 in quarterly dividend payouts. Not bad.

Compounding EPS & Dividends

The next chart uses the same assumptions except instead of spending the dividends; you automatically reinvests them in additional shares of the company’s stock.

Look at what happens to your investment value. Look at what happens to your annual dividends available for retirement income at the end of year 25.

The $1,000 investment has grown to $10,835 and your annual disposable dividend income is $433 – more than twice as much and a nice chunk of change. Congratulations!

Compounding With Monthly Investments

Now what would become of your original $1,000 if you also made additional $25 monthly investments or $300 per year?

After 25 years of adding $25 per month to your investment – a total of $7,500 – your $8,500 (original $1,000 + the additional $7,500) is now worth $40,339. And, your available dividend income is $14,349 per year. Wow!

Getting Rich DRIP by DRIP

Suppose you did that with two or three more stocks – or even five. Suppose you increased your monthly investments as your income grows – say 3% per year.

In the chart above you start out with five $1,000 investments and add $25 per month to each of them. You increase your monthly investments by 3% per year and end up with a total cash investment of $15,938 ($5,000 original investment + $10, 938 in total monthly investments over 25 years).

This produces a value of $91,635. Your dividend income rises to $33,944 a year; all with a very modest commitment.

You can do even better that that – you can get rich DRIP by DRIP.

In the next post I’ll show you how to set up your DRIP account to automatically reinvest your dividends. It’s easy. It’s worth it.

Link to Topics in the Special Report - How to Get Rich Slowly DRIP by DRIP

No comments:

Post a Comment